Compounded semiannually formula

This amounts to a daily interest rate of. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

Formulas To Find Compound Interest Annually Half Yearly Quarterly With Ncert Solutions Youtube

Using the second version of the formula the solution is.

. Compounded SOFR with respect to any interest period means the rate computed in accordance with the following formula and the resulting percentage will be rounded if necessary to the nearest one hundred-thousandth of a percentage point eg 9876541 or 09876541 being rounded down to 987654 or 0987654 and 9876545 or. Lets consider that an individual deposits initially 100000 and that he makes at the end of each year an additional contribution of 5000 over the next 20 years. In this case this calculator automatically ajusts the compounding period to 112.

Using the formula above depositors can apply that daily interest rate to calculate the following total account value after two years. The 100 she would like one year from present day denotes the C1 portion of the formula 5 would be r and the number of periods would simply be 1. How much will she have after 10 years.

Calculation Using the PV Formula. If 15000 is invested at an interest rate of 4 per year compounded semiannually find the value A. Today is the same concept as time.

We multiply five years. An investment of 100 pays 750 percent compounded quarterly. The answer 8573 tells us that receiving 100 in two years is the same as receiving 8573 today if the time value of money is 8 per year compounded annually.

Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate. Must contain at least 4 different symbols. In economics and finance present value PV also known as present discounted value is the value of an expected income stream determined as of the date of valuationThe present value is usually less than the future value because money has interest-earning potential a characteristic referred to as the time value of money except during times of zero- or negative interest rates.

Determine how much your money can grow using the power of compound interest. How to calculate interest compounded semiannually. If for example the interest is compounded monthly you should select the correspondind option.

A t 365 2 A t. The weight of each cash flow is determined by dividing the present value of the. Assume an annual interest rate of 12.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. He is going to receive 3 semi-annual compound interest. Get 247 customer support help when you place a homework help service order with us.

This calculator accepts the folowing intervals. The formula takes whatever amount of money you are investing today and adds it to the interest which is compounded over time. Include additions contributions to the initial deposit or investment for a more detailed calculation.

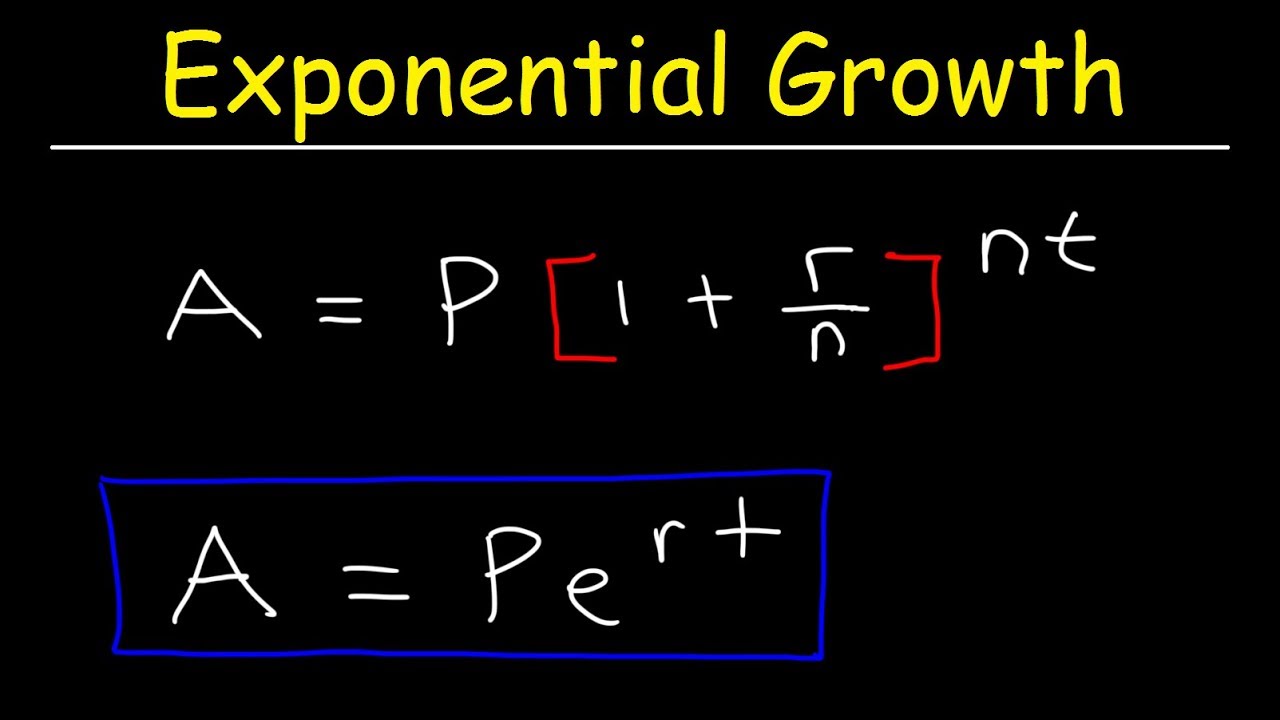

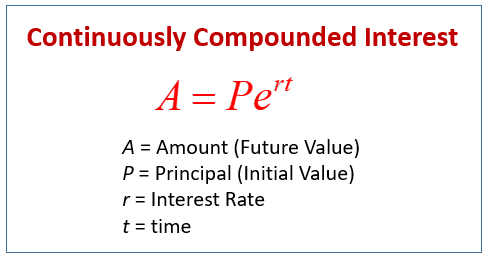

Continuous compounding is the mathematical limit that compound interest can reach. FV Future. The following formula returns the compounded interest rate.

A pension may be a defined benefit plan where a fixed sum is paid regularly to a person or a defined contribution plan. We hope you enjoyed this brief look at evaluating investments using the present value formula. 18 with Semiannually compounding frequency.

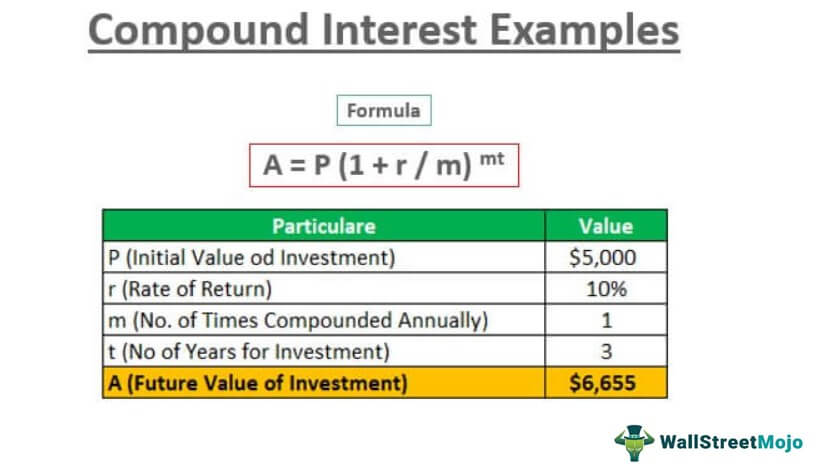

The interest can be compounded annually semiannually quarterly monthly or daily. The present value formula for a single amount is. Lindsey invests 1000 into an account with 4 per year continuously compounded interest.

Years at a given interest rate. It is an extreme case of compounding since most interest is compounded on a monthly quarterly or semiannual. In the meantime lets build a FV formula using the same source data as in monthly compound interest example and see whether we get the same result.

Tony invests in an account that is compounded monthly. What interestreturn rate should an investment generate in order to reach certain future value. Get 247 customer support help when you place a homework help service order with us.

See how much you can save in 5 10 15 25 etc. A pension ˈ p ɛ n ʃ ə n from Latin pensiō payment is a fund into which a sum of money is added during an employees employment years and from which payments are drawn to support the persons retirement from work in the form of periodic payments. Tony and Matt both incest 5000 in an account that receives 3 interest annually for 10 years.

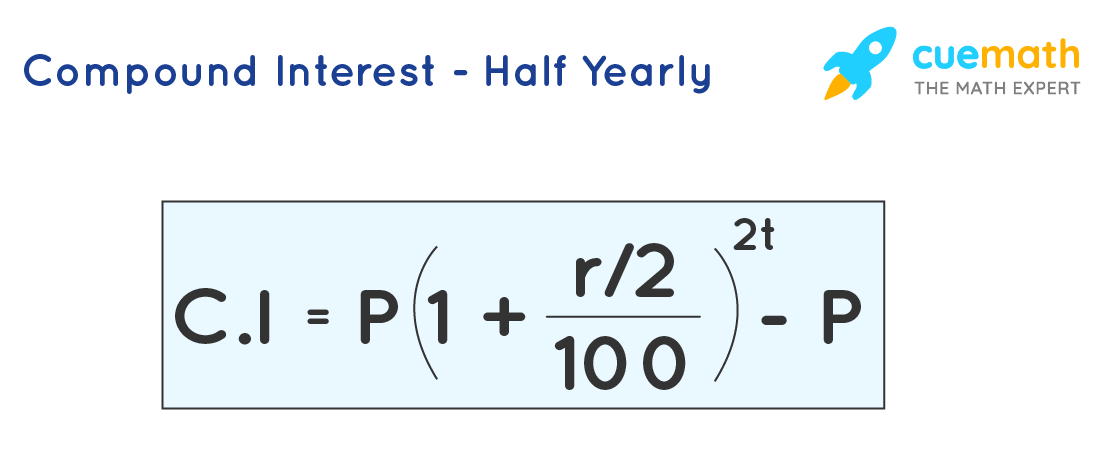

6000 in an investment for five years. The formula to calculate compound interest is-P1in-1 Here is an example of how interest is compounded semi-annually-A person invests Rs. 6 to 30 characters long.

ASCII characters only characters found on a standard US keyboard. Assume that the 1000 in the savings account in the previous example includes a rate of 6 interest compounded daily. As you may remember we deposited 2000 for 5 years into a savings account at 8 annual interest rate compounded.

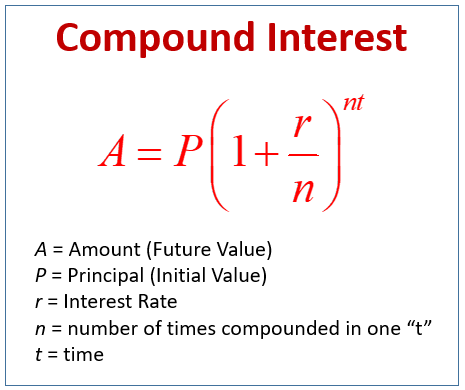

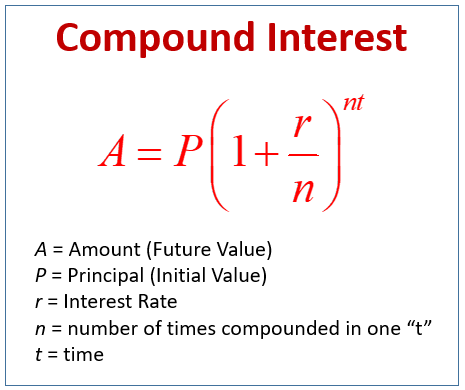

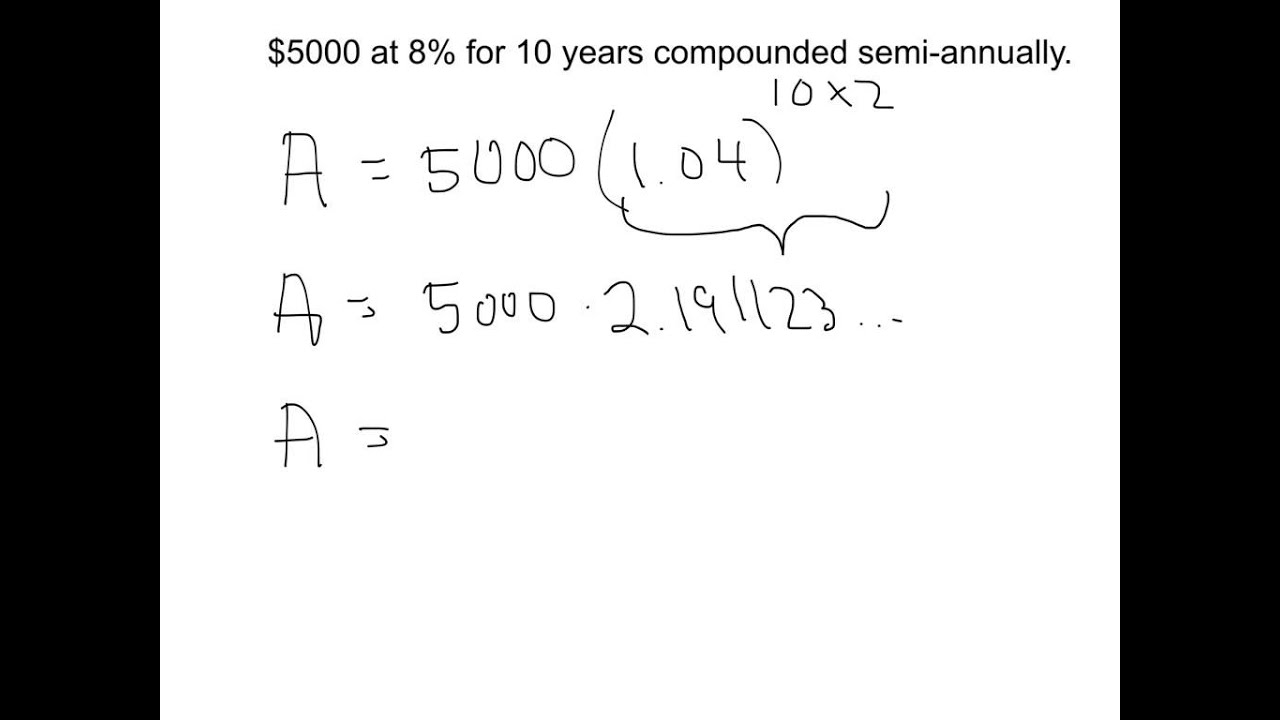

Examples Use the EFFECT Worksheet Function. Because n represents the number of compounding periods and we are compounding semiannually for five years there will be 10 compounding periods. The formula you would use to calculate the total interest if it is compounded is P1in-1.

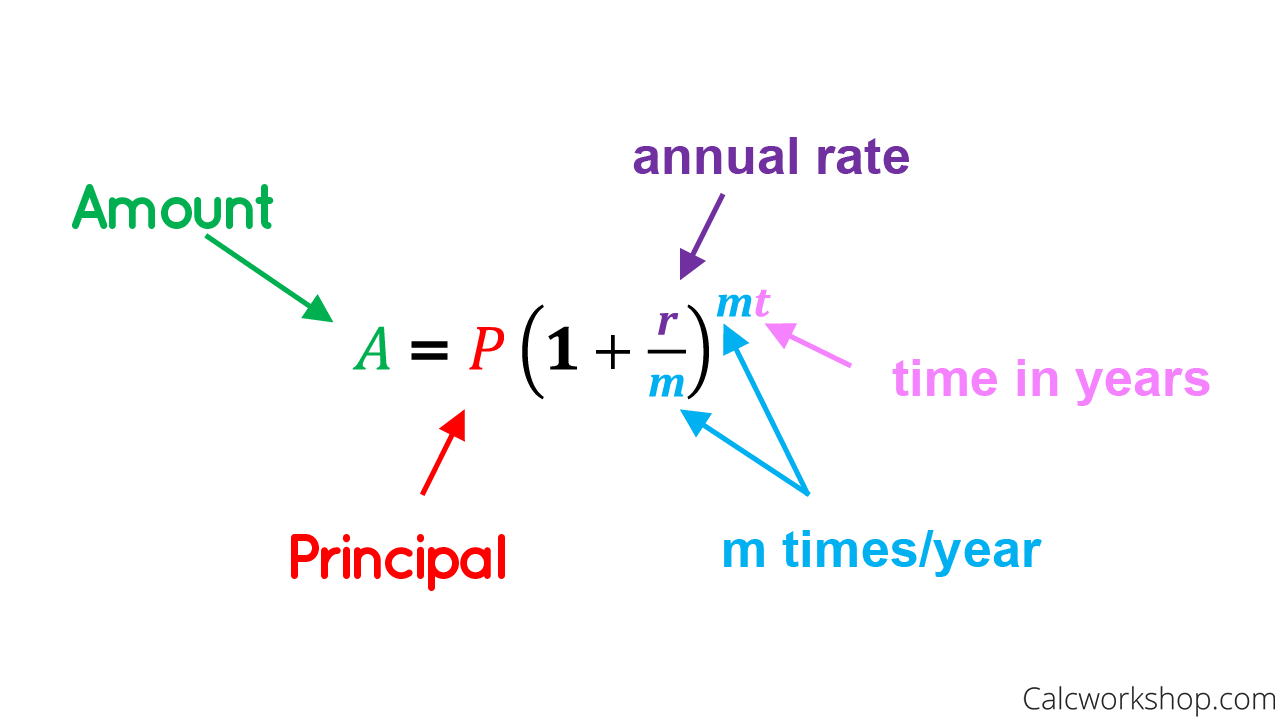

In general the interest rate for the compounding interval annual rate number of compounding periods in one year. The formula is shown below. 15000 is invested at an interest rate of 4 per year compounded semiannuallyTo find the value of.

The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. Here are the steps to solving the compound interest formula. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

The formula for compounded interest is based on the principal P the nominal interest rate i and the number of compounding periods. To use the general equation to return the compounded interest rate use the following equation. Determine the number of compounding terms.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Keep this concept in mind whenever you evaluate your options going forwardThe word discount. If we start the year with 100 and compound only once at the end of the year the principal grows to 112 100 x 112 112.

The detailed explanation of the arguments can be found in the Excel FV function tutorial. First change the interest rate to decimal- 3100 003. The money is left in the account for two years for example.

How long will it take for her investment to double.

Mathematics Of Compounding Accountingcoach

Quarterly Compound Interest Formula Learn Formula For Quarterly Compound Interest

Present Value Frequency Of Compounding Accountingcoach

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

Word Problems Compound Interest Video Lessons Examples And Solutions

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

Compounding Semi Annually Quarterly And Monthly Youtube

Mathematics Of Compounding Accountingcoach

Question Video Interest Compounded Quarterly Nagwa

Word Problems Compound Interest Video Lessons Examples And Solutions

Compound Interest Ci Formulas Calculator

Mathematics Of Compounding Accountingcoach

Compound Interest Formulas Derivation Solved Examples

Compounding Interest Formulas Calculations Examples Video Lesson Transcript Study Com

Compound Interest Examples Annually Monthly Quarterly

How To Calculate Compound Interest 6 Powerful Examples

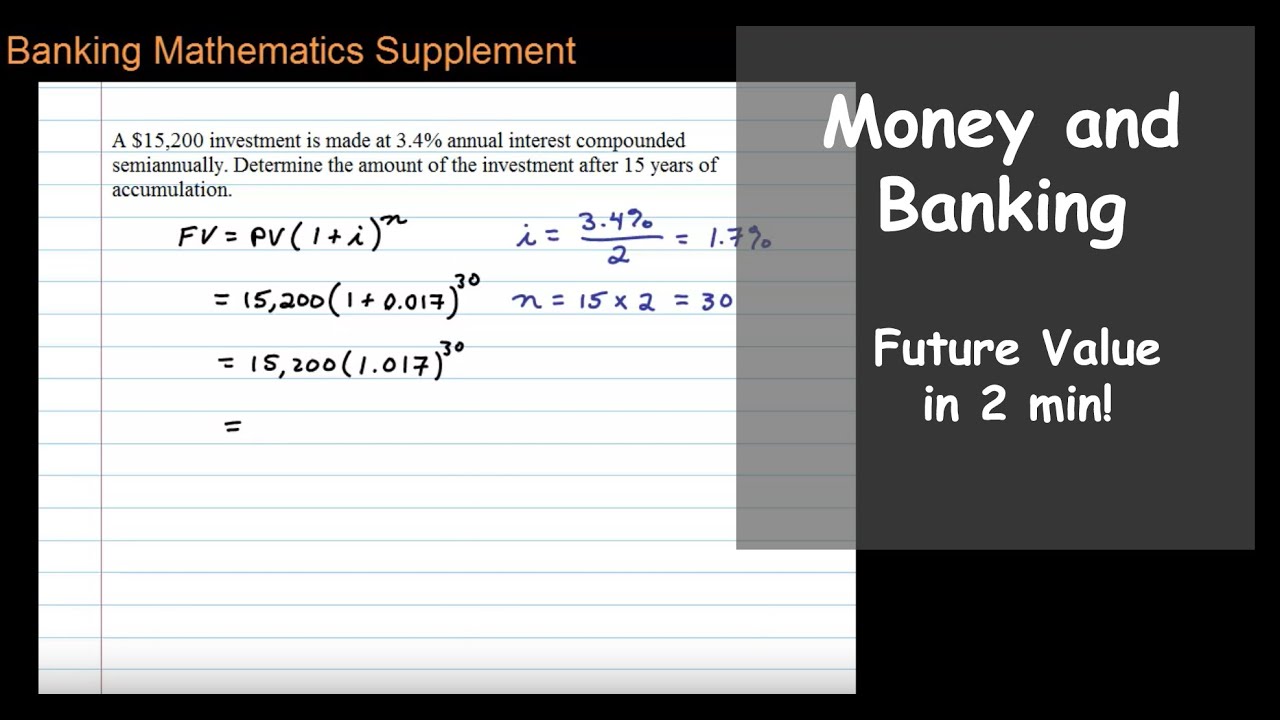

Future Value With Interest Compounded Semiannually Youtube